south dakota used vehicle sales tax rate

That is the amount you will need to pay in sales tax on your. One exception is the sale or purchase of a motor vehicle which is subject to the South dakota has recent rate changes thu jul 01 2021.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Ad Ensuring our customers have an exceptional buying experience since 1962.

. Different areas have varying additional sales taxes as well. With local taxes the total sales tax rate is between 4500 and 7500. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax.

If you are interested in the sales tax on vehicle sales. We are ready to help you narrow down your options and find you the right vehicle. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Free Unlimited Searches Try Now. But that is not all as there are other payments you have to make as well.

The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate. South Dakota Vehicle Excise Tax Explained. The municipal gross receipts tax can.

For vehicles that are being rented or leased see see taxation of leases and rentals. The highest sales tax is in Roslyn with a. 31 rows The state sales tax rate in South Dakota is 4500.

To calculate the sales tax on a car in South Dakota use this easy formula. South Dakota has recent rate changes Thu. The South Dakota Department of Revenue administers these taxes.

The sales tax on a used vehicle is 5 in North Dakota. The South Dakota sales tax and use tax rates are 45. They may also impose a 1 municipal gross.

Ad Get South Dakota Tax Rate By Zip. Owning a car can be rather expensive from the point of buying it. All car sales in South Dakota are subject to the 4 statewide sales tax.

First multiply the price of the car by 4. South Dakota has a 45 statewide sales tax rate. 31 rows The state sales tax rate in South Dakota is 4500.

In addition to taxes car. Municipalities may impose a general municipal sales tax rate of up to 2. For vehicles that are being rented or leased see see taxation of leases and rentals.

The SD sales tax applicable to the sale of cars. South dakota state rates for 2021.

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

States With No Sales Tax On Cars

Sales Use Tax South Dakota Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Use Tax South Dakota Department Of Revenue

South Dakota Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Tem South Dakota Bill Of Sale Car Bill Of Sale Template

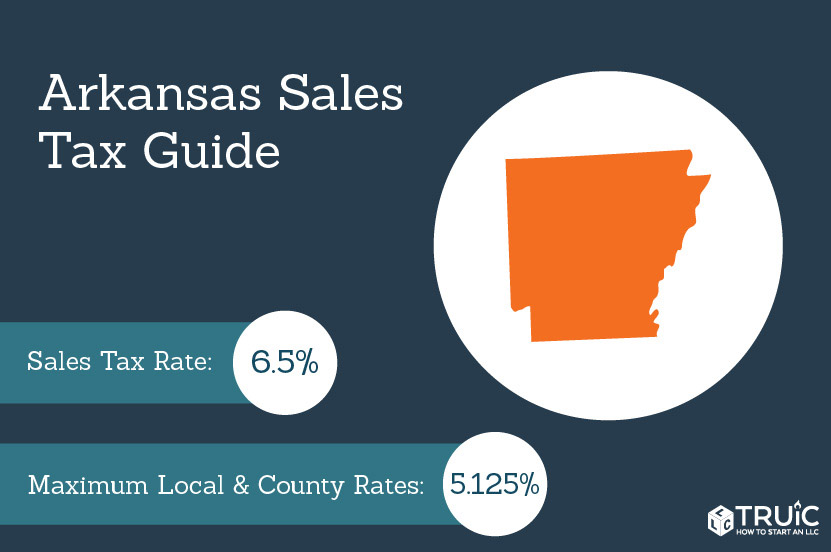

Arkansas Sales Tax Small Business Guide Truic

Highest Gas Tax In The U S By State 2022 Statista

Sales Tax On Cars And Vehicles In South Dakota

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Use Tax South Dakota Department Of Revenue

Printable Bill Of Sale Or Letter Of Gift How To Write A Bill Of Sale Or Letter Of Gift Download This P Bill Of Sale Template Invoice Template Word Lettering